Hello all! Just got back from Addvalue Tech’s AGM which was held on 28/7/2017 at their office in Tai Seng. Today I will be sharing some of the things I learnt from their AGM.

General Atmosphere

The meeting was held in their board room. From the looks of it only about 10-15 shareholders turn up for the meeting. Chairman, COO and 1 independent director were present with the other 2 directors being unable to attend as they were overseas. Only about 4-5 shareholders including myself asked the management questions on their business. Management was quite detailed in explaining their rationale for certain decisions.

1) On the supposed disposal of AVC

AT have announced several times on the supposed disposal of AVC to a China buyer. It has been going on since 2014 with no clear conclusion on the deal. With regards to that, the Chairman’s reply was that the ball is in the court of the buyer. They have fulfilled their end of the deal and are now waiting for the buyer to fulfill their end of the deal.

The Chairman also shared that they are not pressured by the time taken to dispose AVC. They are taking a passive approach in this, and they are in no hurry to close the deal with the buyer. They rather work on building up AT’s brand and image which will eventually pay off if other buyers become interested in buying AVC. As for now, the deal is still fluid.

2) Amortization of AVC

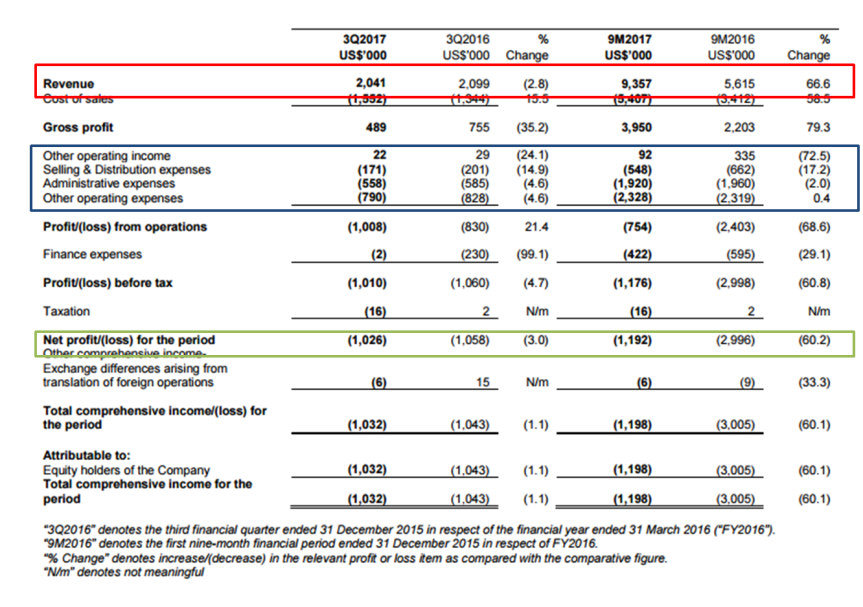

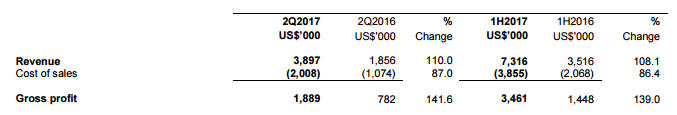

If you were to look closely at their Annual Report, they did mention that most of their losses were contributed due to the amortization of AVC, the subsidiary to be sold. According to the management, FY 2017 results consisted of a 3.5 million dollar loss of which 2.4 million dollars were attributed to the amortization of AVC.

One shareholder asked when the amortization will eventually stop as the amortization has been ongoing for 2 years. The management reply was that there are still a 3.5 million dollar left to be amortized which in my opinion should accounted for in the next FY. The shareholder also asked why does the management not amortized it at one shot rather than do it over a few years. With regards to that, the management reply was that this is basically a number issue and is like a ‘paper loss’.

I eventually asked whether AVC is still functioning as per usual. Their response to that is that most business in AVC are transferred to their main subsidiary and hence AVC is dormant and pending the disposal deal.

3) On the IDRS business

The management are very upbeat about the prospects of the IDRS business. They shared that when they started out building the IDRS several years back they did not expect it to be such a huge thing.

— Potential competitors —

One shareholder asked about the EDRS (supposedly the European Data Relay Satellite) one that can carry out almost the same function as the IDRS. The management response to that is that the EDRS uses the laser function to transmit data which is much more expensive and needs to be very precise. Also, the EDRS is very bulky and big in nature. The EDRS can also transmit more data as it as a wider bandwidth.

Whereas, the IDRS competitive advantage is that it is small and compact which is more suitable for use by LEO satellites as satellite makers are constantly downsizing their satellite. The management also said that IDRS data bandwidth is sufficient as they understood from various LEO satellite makers that they do not require such a high data bandwidth.

Also on the IDRS, they said that it is ready to be commercialise whereby the EDRS is still not ready.

— IP protection —

Management says that the IDRS invention are all copyrighted. One shareholder then ask if it should be patented. With regards to that, the Chairman said that by taking on patent, they would need to disclose their methods in the application and what they do that are so different that requires to be patented. The Chairman says that this will divulge their trade secrets in coming out with the IDRS. On this matter, the Chairman prefers to use copyrights so that none of these techniques are disclosed.

Management also said that they take a serious view in backing up their data weekly and employees have an official log book to write down which part of the invention they are working on so that they have a safeguard if any of these were to leak out.

4) On new business model

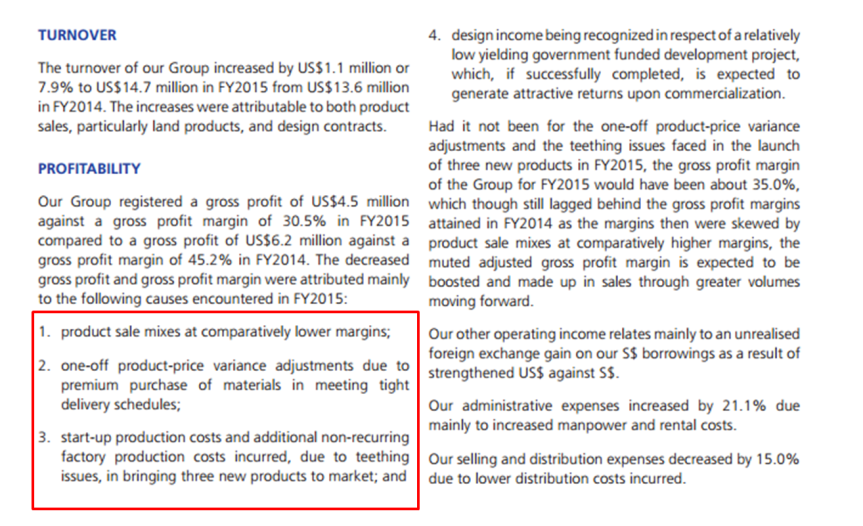

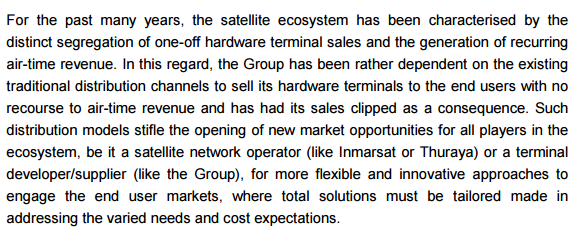

Ever since 2015, Addvalue have redefine their business model by coming out with 2 focus, the “Emerging Market” and the “Commercial”. This is because the downturn of the shipping industry and the O&G sector have hit them hard.

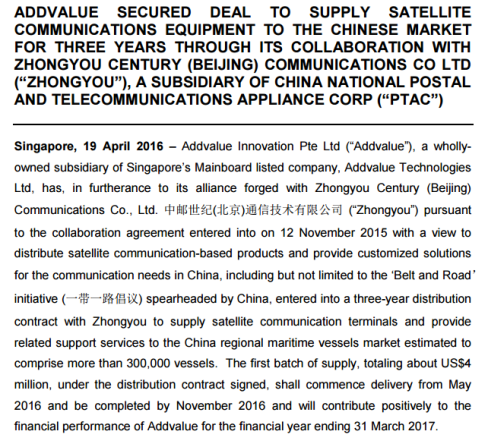

With regards to the Emerging Market focus, management have been taking active steps in penetrating emerging markets as shown from the recent announcement on their entry into the Thailand market. They are seeing potential in these markets as their fishing vessels are old and government are stepping up to prevent overfishing by mandating that their vessels be upgraded with tracking abilities. The management’s plan in China is to latch on bigger players to promote their products there.

On the Commercial focus, the management have pursue a change in direction from one whereby they are only focused on selling their hardware to one that provide whole solutions. The management are embracing that by packaging certain services like weather tracking app, emergency hotline app etc together during the sale. This will help them to earn recurring income from subscriptions.

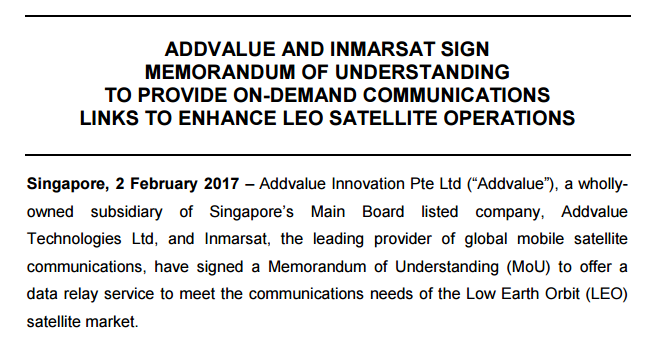

On the airtime revenue agreement with Inmarsat, the Chairman hinted that it is coming “soon”. After I further questioned the COO after the AGM, he said that the airtime revenue agreement will not be a 50-50 as “Inmarsat have a higher upfront costs and investment due to their satellite” etc but it will be “quite a good margin”.

5) On possible spin off of subsidiary

Management guided that they have applied for approval from SGX, but will not be in a hurry to spin it off. They would want to see the IDRS gain some traction first and if spinning it off can attract better investors to further propel the business they would do it.

6) On management

Through the entire AGM, the management have said that they are very prudent in their expenses and the Chairman said that the directors have taken pay cuts over the past few years. (To that we can’t really tell since the exact figures are not disclosed in the AR) Chairman also highlighted the hardship and suffering that they went through these years to get the IDRS business going but eventually persevered to see it through till today.

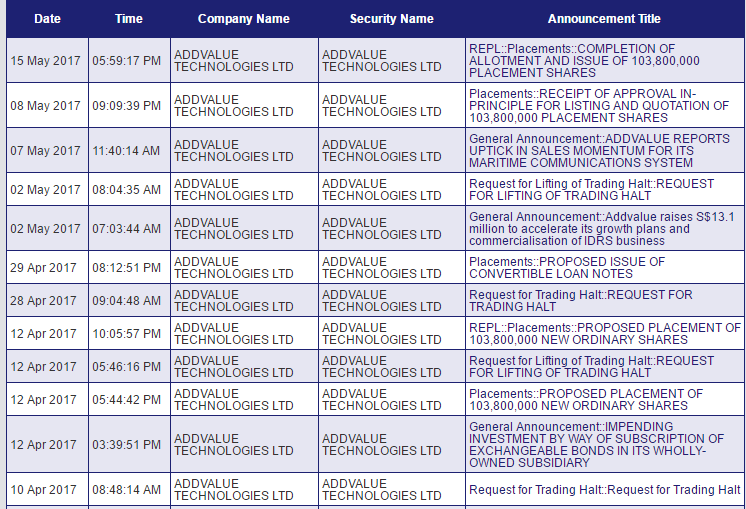

He also mentioned that they are aware and do not want to dilute shareholder’s value hence they did not always go for a placement to raise cash but rather borrow money at a higher rates to fund their operations. However, when they stumbled upon the huge potential of the IDRS, that’s when they decided they have to do a rights issue and eventually raise more money to expand this. He said that for such a small company like them to take on such a huge undertaking of building the world first IDRS is indeed a no easy feat.

In conclusion,

this is most of the main points that I manage to capture from the AGM. Hopefully, its useful information for you! 🙂

For my other posts on Addvalue Tech:

1. Addvalue Tech, a turnaround play?