Hi everyone, first and foremost a Happy National Day to all of my readers! Today I am going further in depth into catalyst investing. I have mentioned quite heavily about how I like to look for catalysts in the company that will boost the share price. Generally, a stock catalyst is an event that will cause the price of the security to move and sometimes quite significantly. This can come in the form of a superb earnings release, a potential takeover offer, special dividend release etc.

The simple rule of thumb is that all catalysts should lead to an increase in either:

1. Revenue and profits

2. Shareholders’ value

It is purely because of events that lead to higher revenues/profits or enhanced shareholders’ value that will eventually cause investors to bid a higher price for a stock. Hence leading to an increase in share price. And depending on the impact of this catalyst, the magnitude of the share price movement varies.

1) Types of catalysts

When I look at catalysts, I tend to divide them into 2 types of catalysts, “Company-specific” and “Sector-specific”.

A company-specific catalyst is one that tend to be applied only to the company and is independent of other companies in the same sector or not. Examples of this includes, a potential takeover offer by another company, disposal of an asset of the company for a sum of money, spinning off of a subsidiary of the company, a new product that is disrupting an industry etc. All these catalysts are specific to the company and tend to either increase revenue for the company or enhance the value of the shareholders.

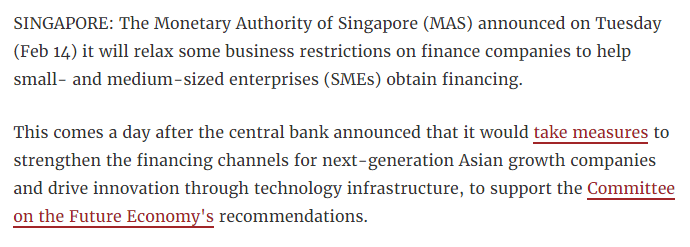

A sector-specific catalyst is one that tend to apply to an entire industry. This could come in the form of an increase demand of a particular industry like how the semiconductor boom this year have provided a favourable tailwind for many semiconductor companies. Those in this sector experience higher earnings QoQ which led to higher stock prices. Also events like lifting of regulations on a certain industry can also lead to higher stock prices as earnings is speculated to improve.

2) Real life examples

I will give you some real life examples of what catalysts can do to a stock price.

— Company specific —

1) Takeover offer

Some of you may know that Global Logistics Properties one of the largest logistics provider in Asia recently received a buy out offer of $3.38 per share from a Chinese consortium. However, this catalyst was not new. GLP had announced that it is undergoing strategic review early this year which eventually culminated in a buyout offer. If you had bought in when the strategic review was announced at $2.60, you are already sitting on a 30% return due to the buyout offer of $3.38.

2) Disposal of asset + special dividend

Neratel announced that they are in talks to dispose off their payment solutions subsidiary on April 29 2016 and are intending to pay out the divestment gains to investors.

This led to a gain of 18.4% if you had bought when the announcement is released in April at $0.49 to a peak of $0.58. Neratel eventually did dispose off the subsidiary and gave out a special dividend of $0.15 per share.

3) Earnings accretive business venture and acquisitions

Acquisitions that are earnings accretive or entering into a new business with huge upside to earnings are also potential catalysts.

I did a post on GSS before here, which talks about their foray into the oil and gas industry (new venture) which many thought was an earnings accretive venture. This caused the stock price to rocket up. Buying at the top of the green circle at $0.28 also gave you about 30% return at the peak of $0.375.

Another example would be MM2 Asia, an entertainment company in Singapore. They produce films like Ah Boys to Men. Since 2016, they have been on several acquisitions, they include buying over cinemas, buying over a concert production company Unusual Entertainment and subsequently spinning off Unusual Entertainment. All these acquisitions have improved MM2’s results tremendously and by spinning off Unusual, it also unlocks value for existing shareholders.

If you had held from the first catalyst announcement in Jan 2016 at $0.20 to the peak at $0.630, this would have been a 315% returns!!

— Industry specific —

Industry specific catalysts generally come in the form of improved sentiments in the industry. Some of yall may know how badly hit the O&G sector was hit due to the drastic drop in oil prices. On the contrary, an improved in sentiments can also bring up the entire industry. For instance, earlier this year MAS announced the relaxation of a regulation governing the financing of SMEs.

This led to all 3 smaller banks listed in Singapore, Hong Leong Finance, Sing Inv & Finance, Singapura Finance to all rise in tandem as investors believe that it will benefit from the new regulations.

If you are following up till now, you will realise that industry specific catalysts are usually more unpredictable compared to a company specific catalysts. However, its also good to choose a company with a good mixture of both. Depending on industry-specific catalysts alone is too risky.

3) Some tell-tale signs to improve accuracy

As you can see from all the examples given above, catalysts are definitely a great booster to a stock’s price. However, one must understand that buying on catalysts is like betting on the future which as investors we should avoid. This is because catalysts depend on many factors to allow it to come to fruition. Just like a company announcement signalling their intention to acquire a new business, it will not become a good investment if the new business do not lead to higher revenue and profits for the company. In this case, it is definitely a catalyst but it has not led to the ultimate end goal.

Thus, it is important to understand how to improve our accuracy when picking catalysts stocks.

— Management —

The management must be capable in order to successfully allow the catalysts to manifest. Thus it is important that the management have a large enough stake in the company (Insider Ownership), so that their interests is aligned with the shareholders. Have the management live up to their promises? A quick run through their Annual Reports should shed some light on the managements’ aspirations for the company. Comparing that with actual results, should shed light to their capability.

Always look out for:

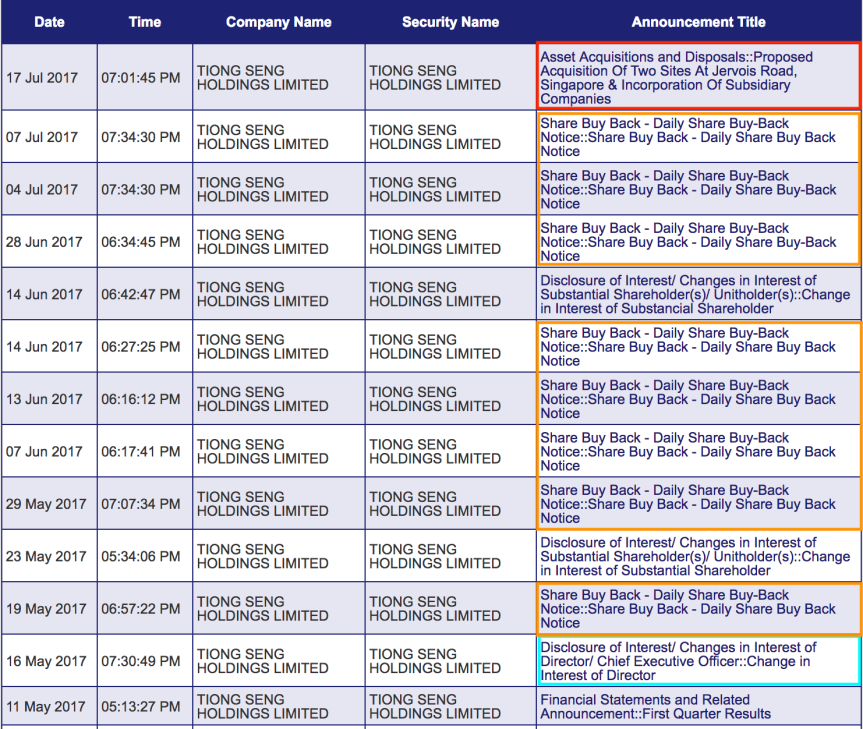

- Insider buying more shares

- Share buyback by the company

These moves are usually an indication of better things coming that will positively benefit the company.

— Timing your entry —

To maximise your returns, one should always look to enter before the catalysts are made known to the general public. This will give you sufficient margin of safety and allow you to lock in the gains when the public come to hear of the catalysts. Doing that is hard because you will not know when it will happen.

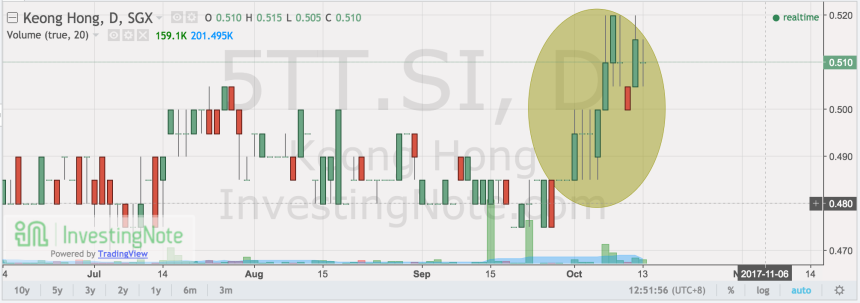

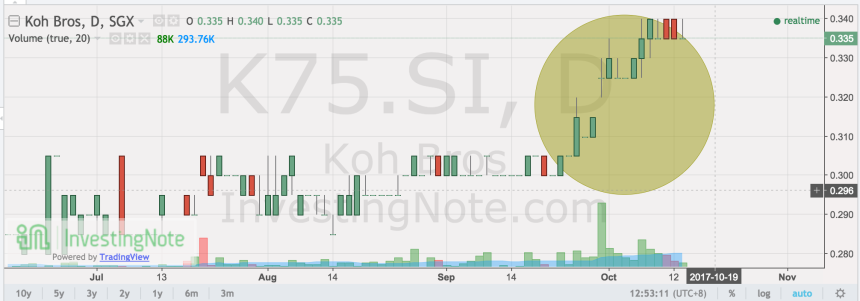

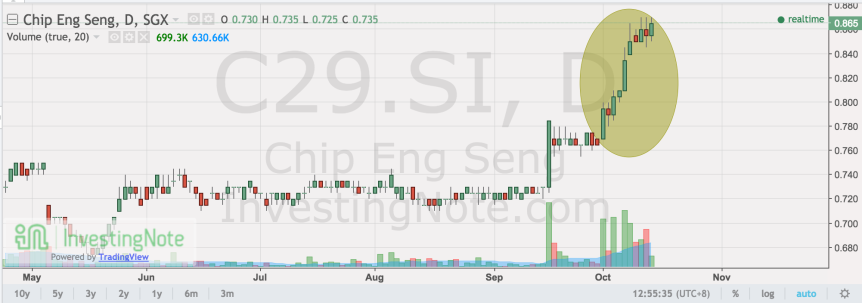

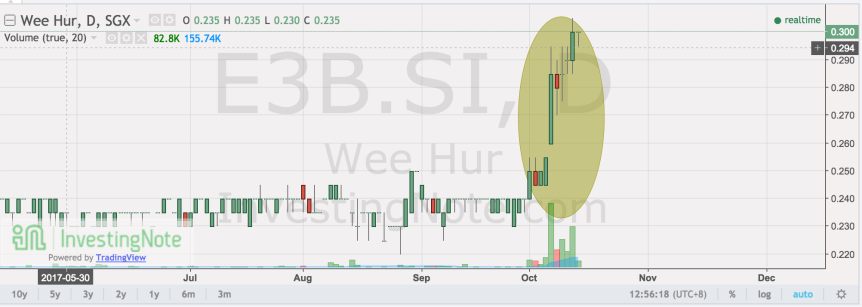

Usually, you will hear of news that this certain catalyst is going to happen to this company but there’s no confirmed date. The best thing you can do is to look for a consolidation phase in the chart and buy on the first breakout.

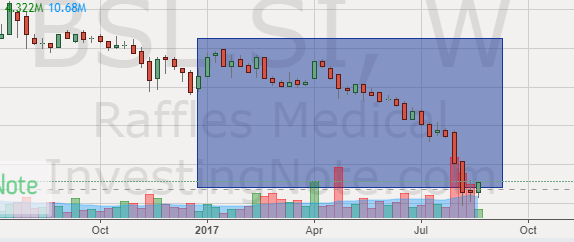

As you can see from the GLP chart. The first breakout in the first week of Jan 2017 is a good time to enter. This is in conjunction with the news released on 5 Jan 2017.

Hence, buying on a strong breakout with high volume is also another way to enter at a better timing as strong volume usually indicates a strong uptrend as buyers are usually funds and big buyers.

In conclusion,

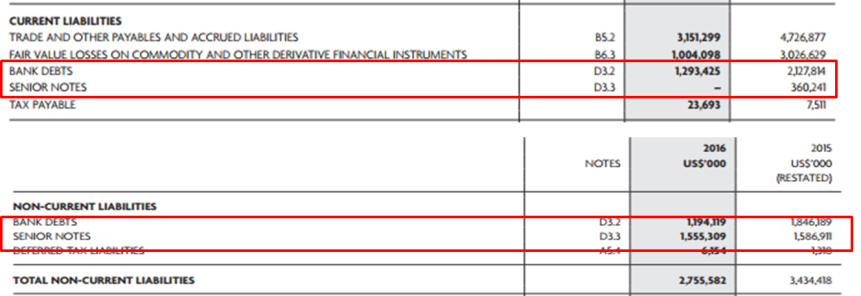

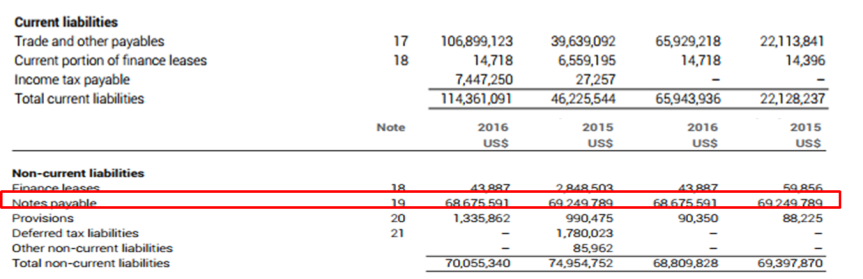

I hope you have learnt a bit more about my own experience on catalyst investing. Buying on catalysts alone is not recommended and this should be mixed with fundamentals analysis of the company including its PE, debts level etc etc. A good stock with strong fundamentals plus good catalysts and a perfect entry timing will be a much safer way to invest on catalysts!

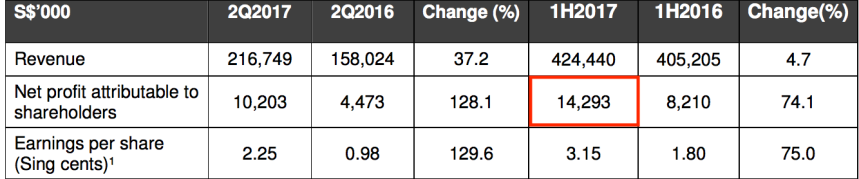

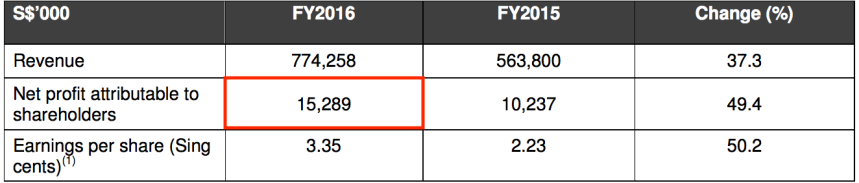

Nordic Group is a global systems integration solutions provider serving mainly the marine, offshore and oil & gas industries. Their business segments include 1) system integration, 2) maintenance, repair, overhaul and trading, 3) precision engineering, 4) scaffolding services 5) Insulation services. Most of their businesses are in the O&G sector but they also do serve the aerospace and medical industries.

Nordic Group is a global systems integration solutions provider serving mainly the marine, offshore and oil & gas industries. Their business segments include 1) system integration, 2) maintenance, repair, overhaul and trading, 3) precision engineering, 4) scaffolding services 5) Insulation services. Most of their businesses are in the O&G sector but they also do serve the aerospace and medical industries.

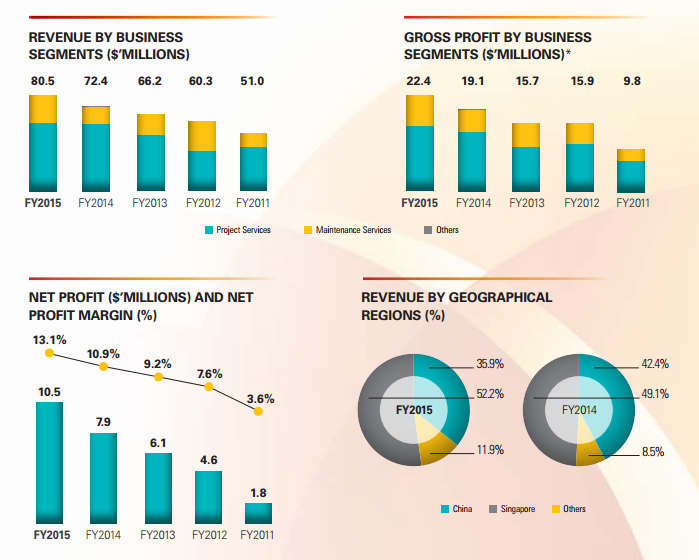

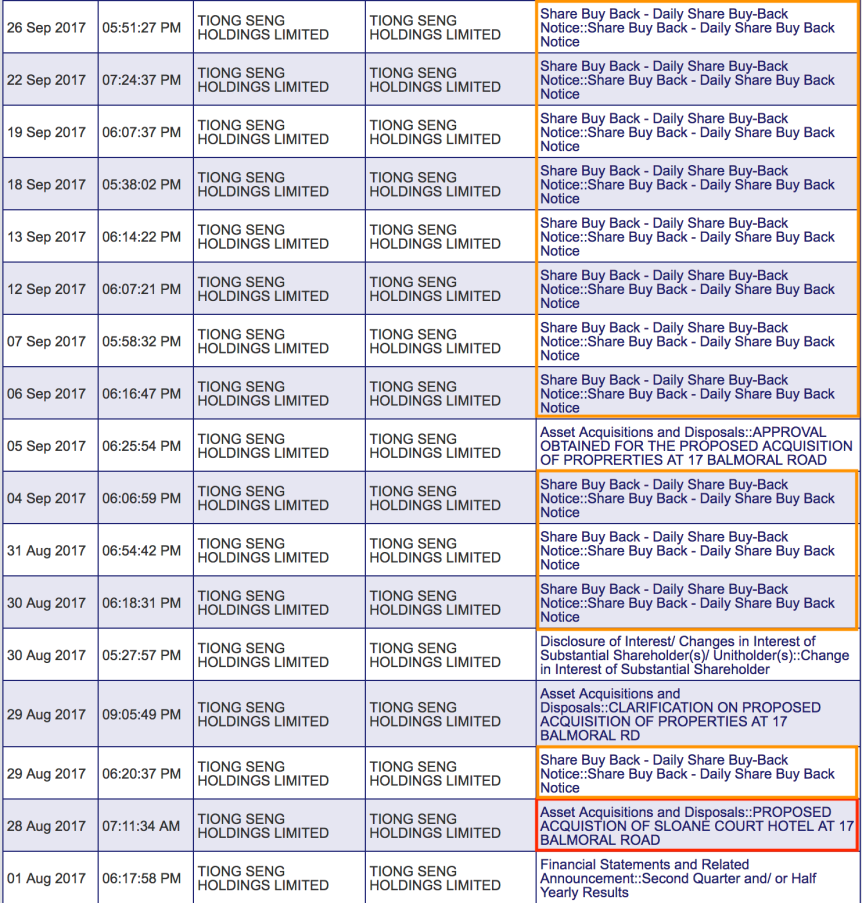

![[Eye Candy]: What has happen to Tiong Seng so far?](https://fromgroundzerosite.wordpress.com/wp-content/uploads/2017/05/tiong-seng-1.jpg?w=863&h=0&crop=1)

![[Eye Candy]: Signs of possible recovery in the construction sector?](https://fromgroundzerosite.wordpress.com/wp-content/uploads/2017/10/construction-pic.jpg?w=863&h=0&crop=1)