Living in a world connected by the internet means information are widely available just a few clicks away. No doubt, I myself have benefited immensely from the information I found online. Today, I want to share with you some of the useful online resources that will definitely be of help to your investing journey.

1) Investopedia

Investopedia was the very first website that I visited to understand more about investing. It is like a huge encyclopedia on anything related to finance. I would say that it is easily one of the top few investing websites that are easy to understand and well organised. Not only are there information on investing, there are information on current affairs, insurance and many more. The only down side of this is that it mainly focuses on the US markets. However I would recommend this website for beginners wanting to invest because their beginners’ tutorials are very comprehensive and easy to understand.

You can find tons of tutorials about investing at this website.

And if you are still clueless where to start from, I have compounded a list of tutorials from Investopedia that you should start with. Click on the link below for you to be teleported there haha.

- Investing Basics 101: A tutorial for beginner investors

- Stock Basics Tutorial

- Bonds Basics Tutorial

- Mutual Funds Tutorial

- Introduction to Fundamental Analysis

- Basics of Technical Analysis

Here you go. Starting out with these few tutorials should allow you to understand investing clearer. If in doubt you can always drop a comment below and I will answer to them 🙂

2) InvestingNote

Think of InvestingNote like a Facebook for investors. It boast a huge collection of users ranging from beginner investors to the very experienced ones. Interestingly, this platform is set up by Singaporeans and was only launched recently. The community in InvestingNote is fantastic as many are willing to share about their strategies and styles of investing. What’s more? You can also find out more about the stocks you are interested in, like the information of the company, what other investors are talking about that stock etc etc.

For instance, if you are trying to find out more about Japfa, you can get a summarised information on Japfa’s price actions, fundamentals and financials on the left and the chart of Japfa on the right. Personally, I find InvestingNote’s charting platform to be one of the best. It allows you to plot your own lines, overlay them with a myriad of indicators and you can even save your drawings on the chart.

Scrolling down further, you can see what are some of the things other users are talking about and the upcoming events the company may have. It currently have information on companies in the SG, US and HK markets. But many of the users of InvestingNote mainly talk about SG stocks which are good for new investors looking to go into the local market.

What’s more important is that you can get these amazing features for FREE. All you have to do is to sign up with them. It seems like I am doing an advertisement for them haha. Rest assured I am not paid to do this. For me, this platform have really accelerated my learning on investing and hence I thought of promoting it to you guys.

3) Investment Blogs

Many investors do have their own blogs where they document their own investment experiences. Some of them are so influential that some investors buy whatever they preach. Personally, some of the blogs that I have came about have helped me in terms of understanding how different investors analyse a company, their investment strategies etc.

I think what’s really beneficial about learning from investment blogs is learning the way others analyse a company. By reading their investment thesis on certain companies, you can understand the way they think which you can apply when you are analysing the company you are planning to invest.

Here’s an article on 55 SG Financial Blogs that are useful.

For me I am a regular reader of TTI, thelittlesnowball, my15hourworkweek and TUBinvesting.

Do give them a visit! 🙂

In conclusion,

good resources are everywhere on the internet. Use it to propel your investment knowledge as much as possible. You will realise that you may not have to even pay a dime to attend courses which teach you about the basics of investing. Also, the best way to learn is from each other. Hence, I believe InvestingNote and reading of other investors’ blogs are two good ways to deepen your understanding of investing. Do note that everyone have their unique styles of investing, different upfront capital and different investment objectives. Thus, completely copying someone else’s method may not suit you. I would suggest adopting good practices and incorporate it into your own method of investing. Hopefully this post can help you realise some of the good investing resources online that will be beneficial to your investing journey!

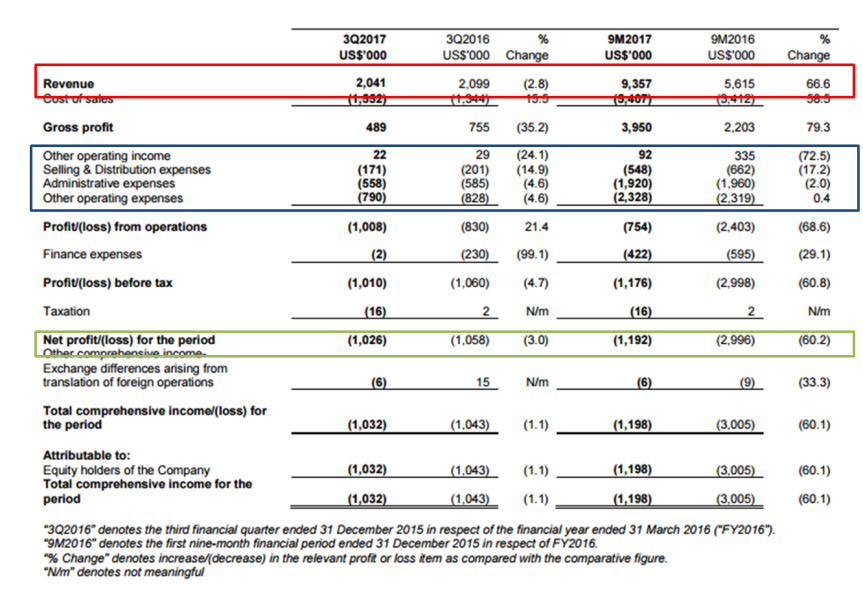

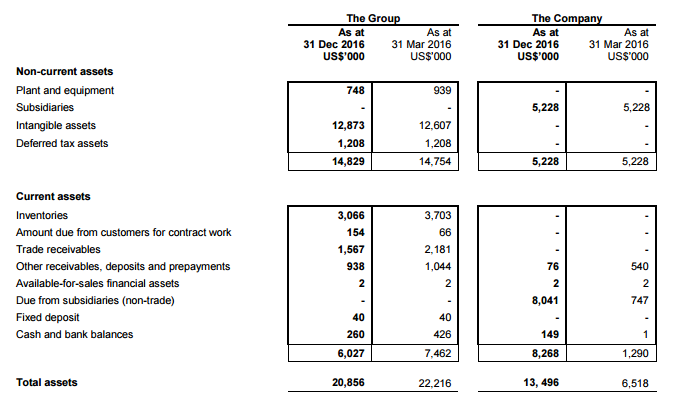

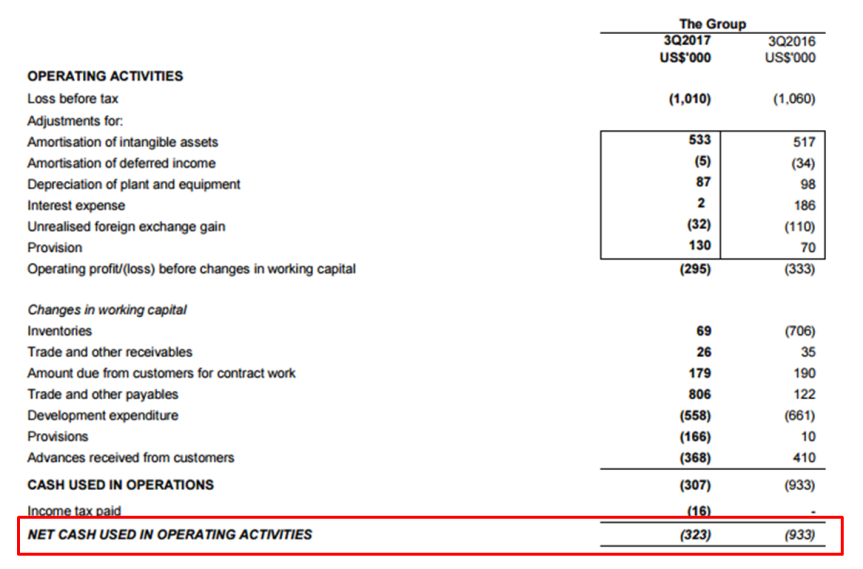

From the cash flow from financing activities, we can see that AT took a 512k loan, which was reflected in the balance sheet above. 9M 2017’s liabilities reflected a 523k in borrowings, which showed that the bulk of the money was borrowed in 3Q17. Furthermore with borrowings > cash & cash equivalents, it reinforces the notion that money continues to be borrowed to finance the company’s operations. This could be a slippery slope, if AT do not record enough cash flow from operations in time to come, as more borrowings will be required to sustain the company. If this gloomy prediction is true, we could see it’s debts balloon up again and calling for another rights issue could be imminent.

From the cash flow from financing activities, we can see that AT took a 512k loan, which was reflected in the balance sheet above. 9M 2017’s liabilities reflected a 523k in borrowings, which showed that the bulk of the money was borrowed in 3Q17. Furthermore with borrowings > cash & cash equivalents, it reinforces the notion that money continues to be borrowed to finance the company’s operations. This could be a slippery slope, if AT do not record enough cash flow from operations in time to come, as more borrowings will be required to sustain the company. If this gloomy prediction is true, we could see it’s debts balloon up again and calling for another rights issue could be imminent.